Carbon accounting provides a science-based measurement of greenhouse gas (GHG) emissions, achieving greater accountability of companies’ emissions causing global warming. GHGs are reported in CO2 equivalents (CO2e), meaning GHGs with widely different chemical qualities and environmental impact can be presented in a single understandable metric. However, the underlying methodology is debatable. This article questions whether the CO2e of Sulfur Hexafluoride (SF6) is misreported.

What is SF6 & Why Is it a Hurdle For a Green Energy Transition?

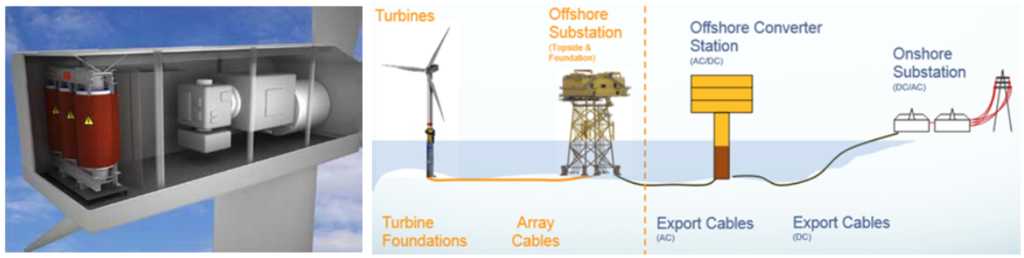

SF6 is used as an insulator in a wide variety of electrical equipment, mainly to prevent fires in incidents of short circuits. It is found in transformers inside windmills, offshore and onshore substations, and in power cables.

Right: an offshore wind energy system (Source: Nordsee One GmbH)

SF6 is a synthetic man-made GHG and cannot be reabsorbed naturally like CO2, meaning once emitted, it does irreversible damage. Most GHGs remain in the atmosphere around 100 years – SF6 remains for 3,200 years. These numbers are given by the Greenhouse Gas Protocol (GGP) based on calculations by the Intergovernmental Panel on Climate Change (IPCC).

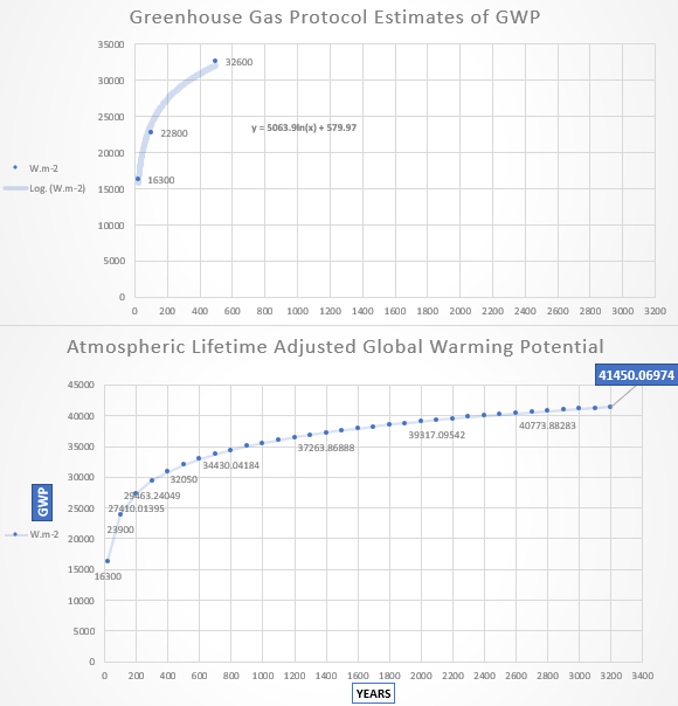

The IPCC’s metric Global Warming Potential (GWP), reveals environmental harm of a given GHG in CO2e. What then, makes SF6 problematic when converted into CO2e? SF6 has a GWP 23,500 times higher than CO2 – a value that is difficult to comprehend. The GWP metric is calculated using a 100-year timeframe based on GHG’s environmental harm. Yet, SF6 has an atmospheric lifetime of 3,200 years, essentially leaving 3,100 years of environmental harm unaccounted for. Using a simple logarithmic function incorporating IPCC data accounting for the missing 3,100 years, the GWP almost doubles. As illustrated below, this indicates how SF6 may be misrepresented in terms of environmental harm in CO2e emissions reporting.

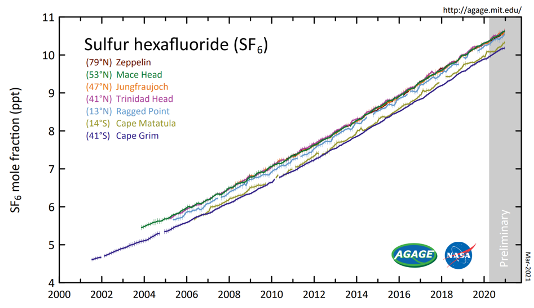

As found by AGAGE – MIT & NASA, other worrying trends are observed. The atmospheric concentration of SF6 has more than doubled in the past 20 years. Luckily, its current concentration in the atmosphere remains low relative to other GHGs such as Methane or Nitrous Oxide.

Regardless, the GWP of these two GHGs pales in comparison to the mindboggling detrimental effect of SF6 on the environment. Emitting this gas should therefore be strictly regulated.

Greenhouse Gas Emissions Reporting – Diverging Approaches

It only takes a little digging into offshore wind energy players to uncover diverging conversion methods of SF6 into CO2 equivalents (CO2e). The GHG emissions reporting methodologies of industry leaders use different emissions factors to convert SF6 into CO2e. An example of underreporting is illustrated by Vattenfall in their 2019 sustainability report, reporting SF6 as 15,000 times more potent than CO2. The emissions factor given by the GGP is 23,500. Ørsted uses a GGP emissions factor for the same gas in their 2019 ESG report. Yet, while Energinet also states it uses the GGP reporting framework in their 2020 CSR report, it uses an emissions factor of 22,800. The ownership distribution between Vattenfall and Ørsted in the Danish wind farm Horns Rev 1 of 40% and 60% respectively, thus blurs accountability and severity of reported emissions. As highlighted by the BBC, atmospheric concentration of SF6 is ten times the reported amount by countries. The IPCC and GGP are also aware of this.

During the past decade…actual SF6 emissions from developed countries are at least twice the reported values.

Fifth Assessment Report of the IPPC.

Measuring Impact of SF6 Leaks by Offshore Wind Players

SF6 emissions will rise exponentially alongside expanding electrified energy infrastructure using equipment containing this gas. This, together with repeated SF6 leaks, perpetuates the worryingly steep upward trend in atmospheric content of SF6 shown above. In 2020, Energinet reported a leak of 763.84kg SF6, or 17,950,240kg CO2e. The environmental impact of this leak is about the same as the emissions of 53 SpaceX rocket launches. Energinet has since admitted to years of underreporting of SF6, leading to amended SF6 emissions related to normal operations doubling.

Leaks of SF6 are too common. In Ørsted’s 2020 ESG report, a major leak at Asnæs Power Station was mentioned without disclosing the actual amount – withholding important risk-related data from investors. However, Energinet disclosed an SF6 leak of 527kg at that same facility in their 2020 CSR report. The leak for which Ørsted is responsible, yet feels is not material to disclose, is therefore potentially around 12,384,500kg CO2e. Indicating light at the end of the tunnel, Vestas has included SF6 on their Restricted Materials list since 2017, as well as introducing a take-back scheme for infrastructure containing this gas – setting a better example for business models of our green energy transition leaders.

Strenghtening the Global Response to Climate Change Risk

It is vital that we understand SF6 is so detrimental to fighting climate change beyond 2100 that it has no place in sustainable business models today. Even if CO2 emissions are reduced in alignment with 2100 Paris Agreement goals, reporting in a 100-year timeframe will not save a planet billions of years old. GHG reporting must be better regulated and scrutinised in order to deliver a truly green energy transition. Releasing a gas causing irreversible damage cannot be an acceptable trade-off for a short-term “green” transition. While most company reports claim no alternatives exist, this is not true. Therefore, SF6-free equipment must be mandatorily installed.

A green transition goes beyond 2100, yet poor regulation enables energy companies to present SF6-CO2e favourably by using lower emission factors. Offshore wind energy players have not provided comparable, accountable, and transparent reporting – indicating stricter regulations on GHG reporting are necessary.

The Way Forward: Better Regulation

In 2014, an EU regulation banned the use of SF6 in all applications except energy after lobbyists argued no alternatives exist. The EU acknowledges the environmental harm of SF6, yet EU action has been described as inadequate. Asset managers, institutional and retail investors are exposed to hidden environmental risks related to SF6 in terms of double materiality. Double materiality referring to the financial costs related to management of SF6 incurred once completely banned. Non-financial reporting of GHG emissions and CO2e needs to be regulated far more than current global regulations. Investors, society, and most of all our environment deserves better protection.

Note by the authors: This article is based on a Copenhagen Business School (CBS) research paper in the course ‘ESG, Sustainable & Impact Investment’ taught by Kristjan Jespersen, Associate Professor at CBS – as part of the newly introduced Minor in ESG. The paper questions the greenness of wind energy by using the case of three large offshore wind energy farms in Denmark: Horns Rev 1 & 2 and Kriegers Flak. The findings are based on ESG, sustainability & annual reports from 2015-2019 of all involved OEMs, manufacturers, operators, and energy grid providers. Implications of the findings point to a coming hurdle within the electrification of a global green energy infrastructure transition.

Esben Holst, an SDG and CSR research intern at Sustainify, is a Danish-Luxembourgish masters student at Copenhagen Business School. Besides attending the newly introduced Minor in ESG at CBS, his past studies focus on international business in Asia and business development studies.

Kristjan Jespersen is an Associate Professor at the Copenhagen Business School. He studies on the growing development and management of Ecosystem Services in developing countries. Within the field, Kristjan focuses his attention on the institutional legitimacy of such initiatives and the overall compensation tools used to ensure compliance.